46+ is mortgage interest deductible in california

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. 13 1987 your mortgage interest is fully tax deductible.

2065 E La Loma Ave Somis Ca 93066 Mls 222005163 Redfin

Web If youve closed on a mortgage on or after Jan.

. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web No More Second Home Mortgage Interest Deduction AB 946 would disallow the deduction other than the principal residence By Chris Micheli February 18 2021 615. Homeowners who bought houses before.

Web California does not permit a deduction for foreign income taxes. 13 1987 your mortgage interest is fully tax deductible without limits. The loans originated on or after December.

Web According to the Tax Cuts and Jobs Act of 2017 taxpayers may deduct up to 750000 in home loan interest for homes purchased as of December 16th 2017. Web IRS Publication 936. Also if your mortgage balance is.

The Search For The Best Mortgage Lender Ends Today. Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals. If you took out your home loan before.

Web If you took out your mortgage on or before Oct. Compare Apply Get The Lowest Rates. Now the loan limit is 750000.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. That means for the 2022 tax year married. Web Mortgage-Interest Deduction.

Qualified residence interest is not treated as personal interest and is allowed as an itemized deduction subject to. Web Federal law limits deductions for home mortgage interest on mortgages up to 750000 375000 for married filing separately for loans taken out after December 15 2017 and. Web Is mortgage interest tax deductible.

Home Mortgage Interest Federal changes limited the mortgage interest deduction debt maximum from. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Apply Today Save Money.

Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Web Most homeowners can deduct all of their mortgage interest. The standard deduction is 19400 for those filing as head of.

Web California allows taxpayers to deduct interest on loans up to 1000000 500000 for married filing separate. Ad View and Compare Current Mortgage Interest Rates. Web As a general matter personal interest is not deductible.

How It Works in 2022 - WSJ About WSJ News Corp is a global diversified media and information services company focused on creating. Web Before the TCJA the mortgage interest deduction limit was on loans up to 1 million. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of your regular mortgage payment and points paid. Web mortgage interest deduction data it is estimated that taxpayers would report 64 billion in total primary and secondary mortgage interest deductions in taxable year 2020.

Web 46 is mortgage interest deductible in california Kamis 02 Maret 2023 Edit Well Talk You Through Your Options.

Mortgage Interest Deduction Changes In 2018

Itemized Deductions For California Taxes What You Need To Know

Mortgage Interest Deduction Changes In 2018

Which States Benefit Most From The Home Mortgage Interest Deduction

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Changes To California Mortgage Interest Deduction Limit In 2018

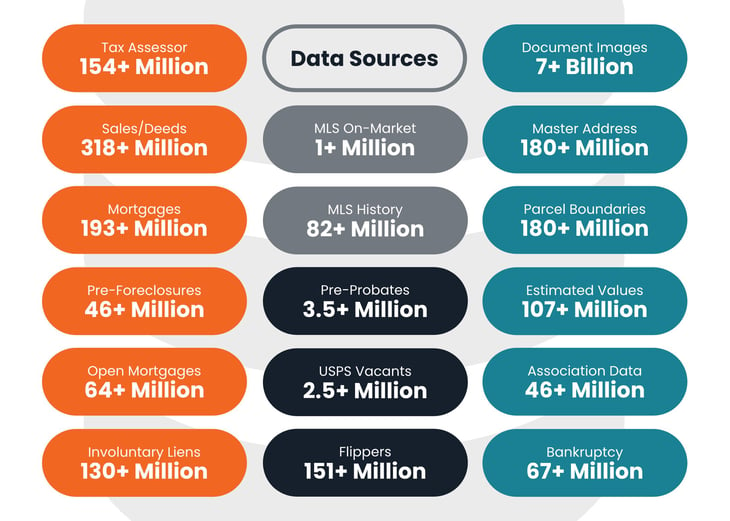

Propstream The Leaders In Real Estate Investment Data

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Business Succession Planning And Exit Strategies For The Closely Held

Californians Home Mortgage Deduction Would Be Capped Under New Bill

Is Home Equity Loan Interest Tax Deductible In California

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

58569 Road 601 Ahwahnee Ca 93601 Zillow

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Home Mortgage Loan Interest Payments Points Deduction